How to use the 50/30/20 methodology to organize your finances

Understanding the 50/30/20 Methodology

Managing your finances can often seem overwhelming, but it doesn’t have to be. With a clear strategy, you can take control of your spending and saving habits. One effective method is the 50/30/20 methodology, a straightforward framework that encourages thoughtful allocation of your income. This method is particularly advantageous in the fast-paced financial landscape of the United States, where economic fluctuations can affect spending power.

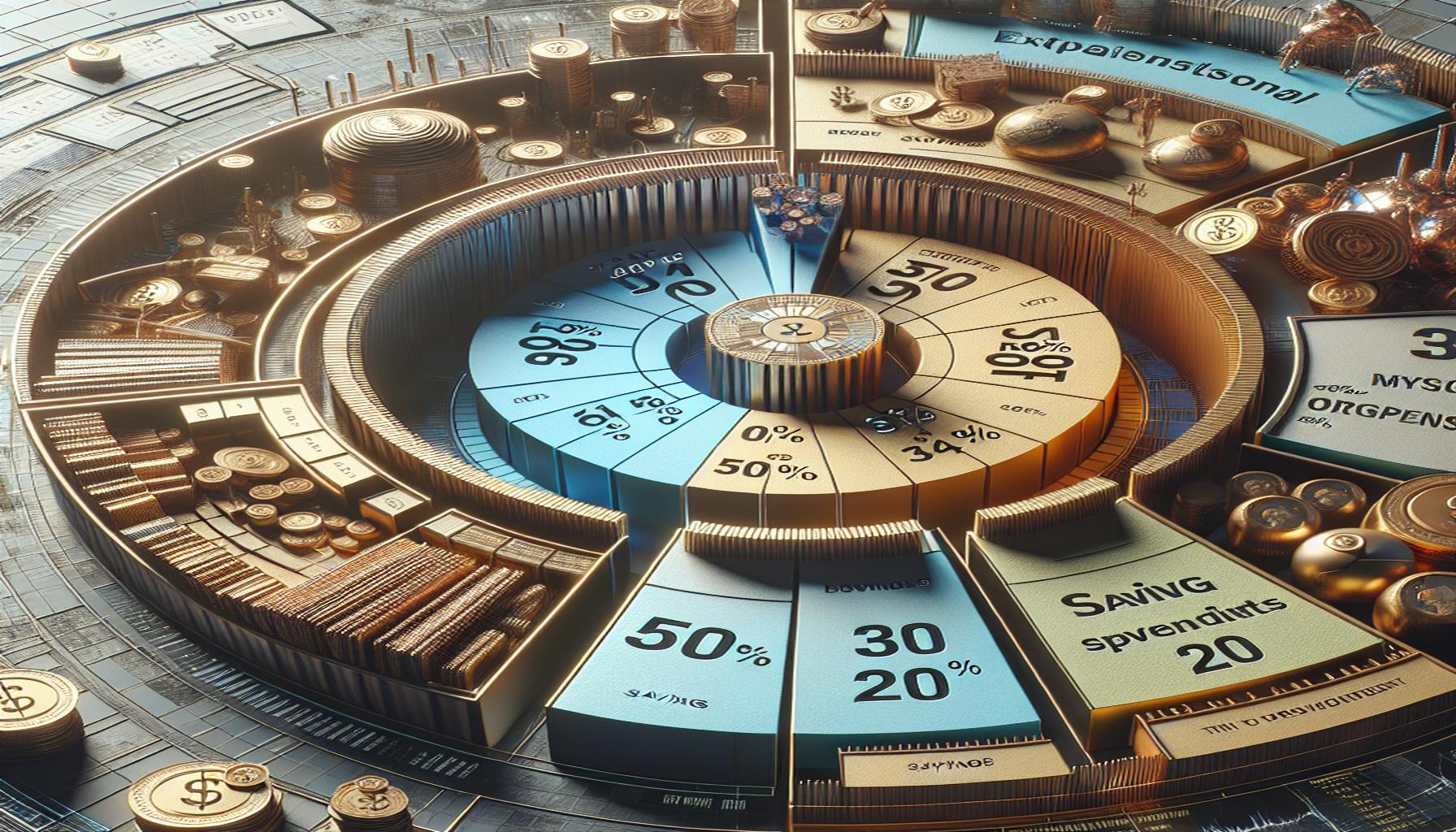

The 50/30/20 rule divides your after-tax income into three key categories to ensure a balanced financial life:

- 50% for needs: This includes essential expenses like housing (rent or mortgage payments), utilities (electricity, water, and gas), groceries for food, transportation costs (gasoline, public transit fares), and health insurance. For instance, if your monthly income is $4,000, you should allocate $2,000 towards these basic necessities.

- 30% for wants: This category encompasses discretionary spending, which might include dining out at restaurants, entertainment such as going to the movies or concerts, travel, and hobbies like crafting or golfing. For example, if you enjoy traveling, perhaps you can save $1,200 each month to allocate for vacations over a few months.

- 20% for savings and debt repayment: This portion focuses on securing your financial future and improving your financial health. You can direct funds toward building an emergency fund (aiming for three to six months’ worth of expenses), investing in retirement accounts, or paying down debts like student loans or credit card balances. For the aforementioned income example, this would amount to $800 monthly.

Implementing this guideline enables you to maintain a balanced approach to your finances. By designating clear percentages, you can track your spending while ensuring that you’re saving for future needs and unexpected expenses. For those who may feel lost in managing their finances, using the 50/30/20 rule lays a clear path to financial literacy and responsibility.

This methodology is particularly useful for individuals seeking to regain control over their finances. It’s adaptable to varying income levels and can accommodate personal financial goals. Whether you’re a recent college graduate navigating student loan repayments or a seasoned professional planning for retirement, the principles behind the 50/30/20 method can provide valuable guidance.

In the sections that follow, we will delve deeper into practical tips for effectively implementing the 50/30/20 strategy, complete with real-life examples to help you maximize your income and secure your financial future.

CHECK OUT: Click here to explore more

Getting Started with the 50/30/20 Methodology

To make the most of the 50/30/20 methodology, it is crucial to accurately determine your after-tax income and carefully categorize your expenses. The first step involves a comprehensive assessment of your financial situation. Here’s how to get started:

Step 1: Calculate Your After-Tax Income

Your after-tax income is the amount you take home after deductions, including federal and state taxes. This figure serves as the foundation upon which you will base your allocations. To find your monthly after-tax income:

- Look at your pay stubs for your net monthly earnings.

- If you have multiple income sources (like freelance work or part-time jobs), be sure to combine these incomes and ensure they are after taxes.

For instance, if you receive a monthly salary of $4,500 but $500 is deducted for taxes, your after-tax income would be $4,000.

Step 2: Outline Your Monthly Expenses

Next, you need to identify and categorize your monthly expenses. Begin by tracking your spending for at least a month to gain insight into your financial habits. Use bank statements, receipts, or budgeting apps to collect information. Once you have your data, divide it into the three categories of the 50/30/20 rule:

- Needs (50%): List all your essential expenses that you cannot avoid. This includes your rent or mortgage, utilities, groceries, transportation, and health insurance.

- Wants (30%): Identify discretionary expenses—things you can live without, such as dining out, gym memberships, hobbies, and entertainment costs.

- Savings and Debt Repayment (20%): Note down your contributions to savings accounts, retirement plans, or the amounts set aside to pay off debts.

Let’s use the earlier example where your after-tax income is $4,000. This means you should allocate:

- $2,000 for needs

- $1,200 for wants

- $800 for savings and debt repayment

Step 3: Adjust and Track Your Spending

Once you’ve outlined your expenses, compare your current spending with the allocated percentages. If you find that your “needs” exceed 50%, consider adjusting your lifestyle choices or looking for ways to cut back, such as switching to a more affordable grocery brand or negotiating your insurance rates. If your “wants” fall under 30%, you might increase your savings to ensure you are prepared for future financial goals or emergencies.

Tracking your spending over time will help you stick to your budget and meet your financial objectives. Consider using budgeting tools or apps to make this process easier. With diligence and commitment, you will find that the 50/30/20 methodology can transform your financial life into one that is organized and aligned with your long-term goals.

CHECK OUT: Click here to explore more

Implementing Your Budget Effectively

Once you’ve established your budget using the 50/30/20 methodology, the next step is implementing it into your daily life to establish better financial habits. This entails not just sticking to your budgeted amounts but also being flexible and adjusting as necessary. Here are several strategies to help you implement your 50/30/20 budget effectively:

Step 4: Create Automatic Transfers

One of the simplest ways to ensure you are consistently saving and allocating funds according to your budget is to set up automatic transfers. For instance, if you determine that you need to save $800 per month, consider establishing a separate savings account and setting up an automatic transfer of this amount right after you receive your paycheck. This method guarantees that you pay yourself first before spending on wants and needs.

Additionally, setting up automated payments for your bills can help you avoid late fees and nip potential financial troubles in the bud. Automating your finances not only reduces the risk of overspending in your “wants” category but also helps you develop a consistent saving habit.

Step 5: Review and Adjust Periodically

Your financial situation is not static; it changes due to various factors such as changes in income, expenses, or financial goals. Therefore, periodically reviewing your 50/30/20 budget is crucial. Aim to evaluate your budget every three to six months. For example, if you receive a promotion and your after-tax income increases to $5,000, you should update your budget allocations to reflect your new income level:

- Needs (50%): $2,500

- Wants (30%): $1,500

- Savings and Debt Repayment (20%): $1,000

This review process not only ensures that you remain on track with your financial goals but can also provide insight into your spending patterns. You might find, for instance, that you’re consistently underspending on the “wants” category, allowing you to allocate more toward savings or investment opportunities.

Step 6: Monitor Your Progress

Tracking your progress is essential to staying on top of your goals and holding yourself accountable. Consider using personal finance applications like Mint or YNAB (You Need A Budget) that can help you monitor your budget categories in real time. These tools can provide visual representations of your spending against your set allocations, making it easier to see where splurges occur.

Moreover, tracking can create a sense of accomplishment as you witness your savings grow over time or as you reduce your debt. For example, if you can manage to hit your savings target for six months in a row, reward yourself with a small treat—this will help keep you motivated.

Step 7: Communication and Accountability

If you share financial responsibilities with a partner or family, communication is key to successful budgeting. Make it a habit to discuss your financial goals and budgeting practices to foster a healthy environment for financial discussions. Set regular “money dates” where you can analyze your spending habits together and adjust your budget as needed.

Furthermore, consider involving a trusted friend or family member to act as a mentor or accountability partner. Sharing your progress and challenges with someone can provide motivation and support as you work towards your financial goals. After all, managing finances can feel overwhelming at times, and having an ally can make a significant difference.

SEE ALSO: Click here to read another article

Conclusion

Understanding your financial landscape is vital, and utilizing the 50/30/20 methodology can be a transformative strategy in achieving that understanding. By categorizing your income—allocating 50% for needs such as housing, groceries, and utilities; 30% for wants like dining out, entertainment, and vacations; and 20% for savings and debt repayment, you create a clear framework that promotes healthier financial habits. For example, if you earn $4,000 a month, allocating $2,000 for essentials ensures your basic needs are met while allowing you to enjoy life within your means.

The practical steps you take to implement this budgeting strategy are essential for its success. Setting up automatic transfers to your savings account can help you consistently contribute towards your financial goals each month, making saving effortless. Regularly reviewing and adjusting your budget ensures that you remain aligned with your changing financial circumstances, whether it be a raise at work, an unexpected expense, or the decision to settle a debt faster.

Flexibility is a key component of this approach. Life is unpredictable; personal circumstances such as job changes or new family members may require you to revisit your budget. In these moments, clear communication with your partner or accountability partner provides a support system, reinforcing your commitment to financial wellness. When both partners work towards shared goals, it fosters an environment of collaboration and mutual encouragement.

As you delve deeper into the 50/30/20 methodology, you might find that not only does it help in achieving financial stability, but it also brings a sense of peace regarding your financial decisions. This structured approach allows you to be more informed about where your money goes, empowers you to control spending, and ultimately helps you work towards a more secure financial future. By taking that initial step today—crafting and implementing your budget—you are setting the stage for a fulfilling and financially responsible life.

Related posts:

How to Create an Effective Financial Budget for Your Family

How to Set Financial Priorities to Get Out of Debt

Simple Strategies to Improve Your Personal Financial Health

The impact of compound interest on debts and investments

How to Start Your Journey in Financial Education from Scratch

Step by Step to Build a Solid Emergency Fund

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.