Essential Care Before Taking Out a Payroll Loan

Payroll loans can provide quick financial relief, but they come with high-interest rates and potential debt cycles. It’s crucial to assess your financial situation, research lenders, understand loan terms, and consider long-term implications. Responsible preparation can ensure these loans serve rather than hinder your financial health.

How Personal Loan Refinancing Works

Personal loan refinancing is a strategic financial move that can lower interest rates, reduce monthly payments, and consolidate debt. By understanding the process, evaluating your current situation, and comparing loan offers, you can make informed decisions to enhance your financial health and achieve your financial goals effectively.

What to do when you can’t pay all your debts

When struggling to pay debts, it’s essential to understand your financial situation and prioritize obligations. Options like debt consolidation, credit counseling, and negotiating with creditors can help. Be cautious of scams and communicate openly with loved ones. Proactive steps lead to a more stable financial future.

How to Negotiate Lower Interest Rates on Your Loans

Negotiating lower interest rates on loans can lead to significant savings and improved financial health. With proper preparation, understanding market rates, and effective communication, borrowers can enhance their chances of securing better terms, ultimately fostering a stronger relationship with their lenders while working towards their financial goals.

Strategies for Managing Student Debt Sustainably

This article provides practical strategies for managing student debt, emphasizing budgeting, understanding loan types, exploring repayment plans, and leveraging forgiveness programs. It encourages proactive financial management to alleviate stress, improve credit, and promote long-term stability, ultimately guiding readers toward a debt-free future.

What to Consider Before Applying for an Online Personal Loan

Applying for an online personal loan requires careful evaluation of your financial situation. Key factors to consider include your credit score, loan amount, terms, and repayment ability. By understanding these elements, you can make informed decisions that align with your financial goals and enhance your economic stability.

How to consolidate debts without harming your credit

This article explains how to consolidate debts without harming your credit score. It outlines effective strategies, such as choosing the right consolidation method, maintaining consistent payment habits, keeping old accounts open, and budgeting wisely, ensuring financial stability while enhancing your credit health.

Advantages and disadvantages of refinancing debts

Refinancing debts can offer significant benefits, such as lower interest rates and simplified payments, but also comes with drawbacks like closing costs and potential credit score impacts. Evaluating personal financial situations is crucial to making informed decisions that align with long-term financial goals.

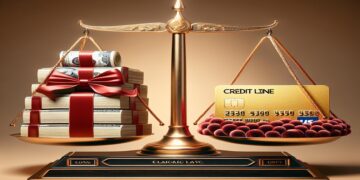

Differences between personal loans and credit lines: which one to choose?

This article explores the key differences between personal loans and credit lines, highlighting their unique features, costs, and repayment structures. It provides insights to help readers assess their financial needs, emphasizing the importance of understanding each option's benefits and drawbacks for informed borrowing decisions.

Practical tips to pay off credit card debt faster

Managing credit card debt can be challenging, but with effective strategies like prioritizing high-interest payments, making extra payments, and utilizing balance transfers, you can pay off your debt faster. Establishing a budget, automating payments, and tracking your progress will empower you to achieve financial freedom and sustainable habits.